Known since 2016, the (SAF-T) Standard Audit File for Tax has come a long way, which until now could be described as evolutionary changes.

The year 2020 will bring further changes for entrepreneurs in the area of VAT reporting. This time the changes will be rather revolutionary.

Act of 4 July 2019 imposes new obligations regarding VAT reporting on entrepreneurs. From April 1, 2020, one type of JPK file will be introduced for large enterprises. The new file was called JPK_VDEK in 2019 – today named JPK_V7M or JPK_V7K.

What, where, when?

Since April 1, 2020, large enterprises and from July 1, 2020, other companies, the legislator will introduce one type of JPK file. This file will contain two parts:

- Registration part

- The data will be sent monthly as it currently operates SAT-T

- It will contain a much wider range of data to be submitted to the Ministry of Finance

- Declaration part

- It will replace current declarations VAT-7M or VAT-7K, VAT-27, and other supplementary declarations like VAT-ZZ, VAT-ZT, and VAT-ZD.

- The declaration part will be sent in periods same as currently VAT declarations are sent (monthly or quarterly)

- For example

- JPK_V7K only registration part for January – You need send the XML file by February 25

- JPK_V7K only registration part for February – You need send the XML file by March 25

- JPK_V7K registration part for March and declaration for January, February and March – You need send to 25 April

The registration part contains new tags that have not yet been reported previously in any reports sent to the offices. This means that from April 1, you must post transactions in a way that ensures proper reporting from May 25, 2020, according to the JPK_VDEK structure, such as:

- Commodity groups

- Sales and purchasing procedures

- Types of sales and purchase documents

The detailed scope of data contained in tax returns and records has been introduced by the Regulation of the Minister of Finance, Investment and Development of October 15, 2019 (DZ.U. 2019r. Poz. 1988).

How?

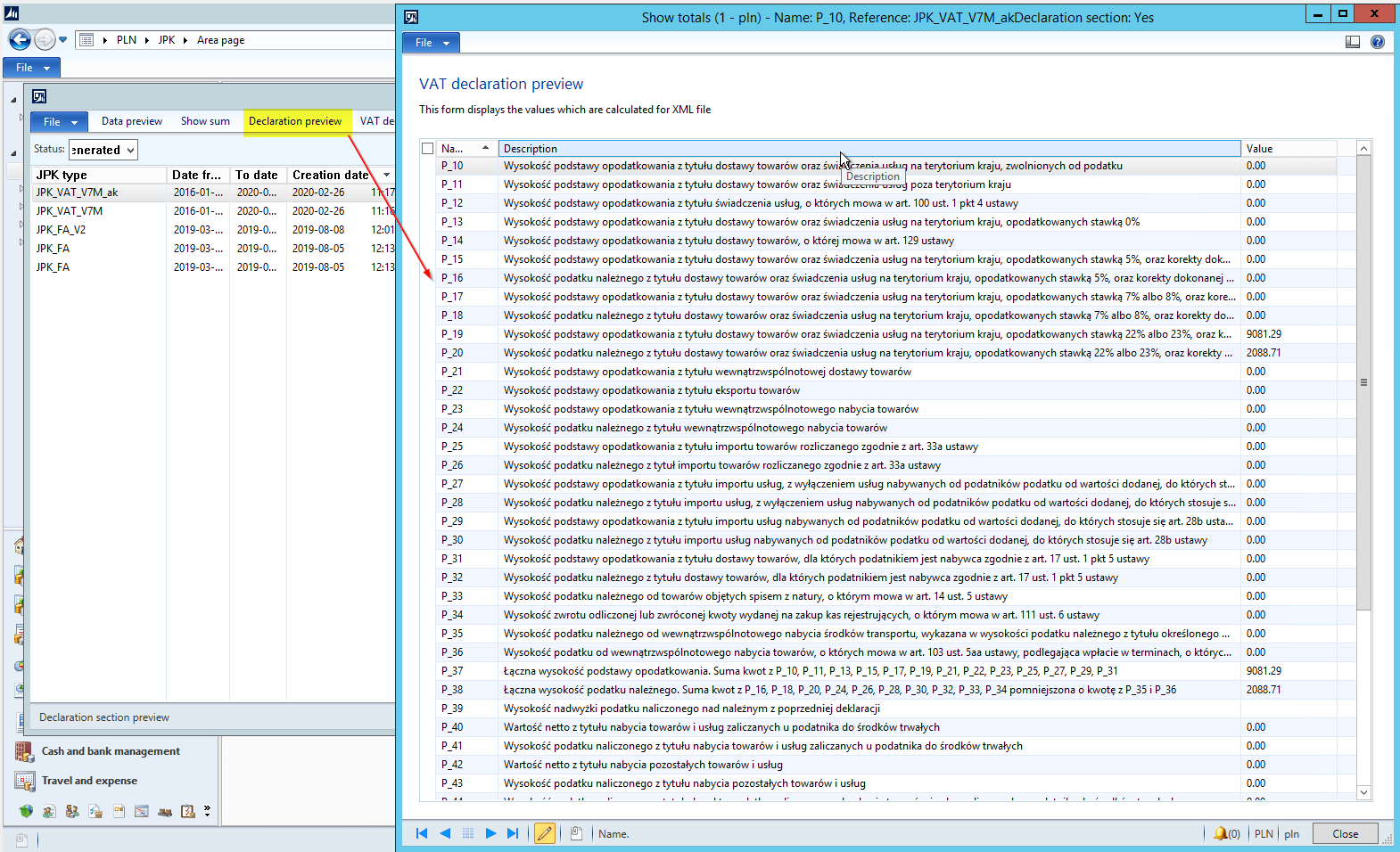

SiiJPK_VDEK is a solution that assists entrepreneurs in the process of correct recording as well as reporting VAT data.

Thanks to flexible parameterization, which is based on standard tax elements and other settings and data in the system, we are able to precisely configure where the data need to be collected from.

The solution mainly takes data directly from the transactions posted, collecting relevant information from source documents. Collected data after appropriate processing, are transferred to the JPK_VDEK records.

Generating the registrations and declaration part is done in one process.

The results of the process are saved in the history of generating JPK_VDEK. Data that cannot be calculated from the registration part can be updated and corrected if necessary before the declaration in the XML file will be sent.

When the process is complete, the person responsible for VAT reporting can generate an XML.

Leave a comment